FAQs

A full list of FAQs related to the sheet. Have one that isn't answered here? Ask in the subreddit!

Using the Sheet

How do I enter my own historical data into a new Sheet?

To enter your own historical data into the Sheet:

Go to the History tab

Start in Cell A3 and work downward, entering dates (e.g., 1/6/2020, 1/7/2020) for your previous data. Don't worry about existing months—they will automatically move down.

For each new month you've entered, fill out the values in the blue columns from left to right.

How do I know my data is kept private?

The Sheet is completely self-contained. When you download and make a copy, it becomes an independent version hosted by you. The "external services permission" is needed because the Sheet fetches live Crypto, Stock, and Managed Fund prices from sources like Google Finance, Yahoo Finance, and Bloomberg.

You can review all formulas to see how this works—it's strictly a one-way fetch process. By examining the Tools -> Script Editor code, you can verify everything yourself. No personally identifying information or sensitive data like passwords/usernames are needed or requested. The only inputs are your holdings and amounts—the minimum information needed to track your net worth and performance.

There are two versions of the sheet:

Full version: Contains all features but requires additional permissions

Slimmed version: More private and self-contained but with some features removed

You'll receive links to both versions in your email invite.

What is the difference between the Full and Slimmed Versions?

Full Version Permissions:

See, edit, create, and delete all your Google Sheets spreadsheets - To allow the Migration tool to automatically copy your data across from an older Sheet version when you upgrade to a newer version.

Connect to an external service - To allow the fetching of live Stock/Crypto/ETF prices from sources such as MorningStar, Yahoo, FT.com and CoinMarketCap where GoogleFinance does not provide a live price.

Send email as you - To send you a record of your end of month progress

Display and run third-party web content in prompts and sidebars inside Google applications - To display the end of month summary prompt in your Google Sheet (same content as the Email)

Slimmed Version Permissions:

View and manage spreadsheets that this application has been installed in - To allow the script to process your monthly numbers and then write them back to the Sheet as history in the History Tab

Connect to an external service - To allow the fetching of live Stock/Crypto/ETF prices from sources such as MorningStar, Yahoo, FT.com and CoinMarketCap where GoogleFinance does not provide a live price.

Display and run third-party web content in prompts and sidebars inside Google applications - To display the end of month summary prompt in your Google Sheet

Missing features - No migration tool (if the destination sheet), monthly email updates or calender invites/prompts.

What region of the Sheet should I pick?

Choose the Sheet region that matches where you live due to retirement/tax differences, or alternatively, choose based on the currency you're paid in if you earn internationally.

When do I press record for the month?

You should record a month while you're inside that month (e.g., January should be recorded between Jan 1-31).

When to record within the month is flexible — you can do it at the beginning or end, depending on when you want your financial snapshot to represent (start of January or end of January).

If you accidentally miss recording within the month, see entering a missed month.

I accidentally clicked the button to end the month too early and hadn't updated all my assets, what do I do?

To undo an accidental month recording:

Click File -> Version History -> See Version History

In the right sidebar, click on the dated version of the Sheet from before you clicked to end the month

Click the green 'Restore this version' button at the top of the screen

Finish entering your data and run the Sheet again

A new Sheet update is released, how do I upgrade to a new Sheet?

Click here to request the latest invite if needed

How do I migrate data between sheets?

As of v2.9, the new Automated Migration Tool handles all Sheet migrations and updates. See instructions on how to upgrade/migrate your sheet here.

How do I enter in a missed month?

If you missed recording a month, you have two options:

Use the lookback functionality - Preferred if you're close to the missed date (within ~30 days). See the recording-a-month guide for details.

Manually enter historical data - For entering past months or editing a specific past month.

To manually backfill data:

In the History tab, enter the date you want to backfill in Column A, keeping correct order with existing months. For first-time users, simply write the missed date in Cell A3.

Note: Do not insert new rows—use the rows already in the Sheet.

Fill out the Asset values for the new month (blue columns only).

Done! The Date Column will automatically adjust, and the current month will shift down.

Can I use the Sheet with Excel, Offline or Libre Office?

Unfortunately, no. The Sheet relies heavily on Google Sheets functions for live pricing, custom Google formulas, and behind-the-scenes scripts written in Google Apps Scripts. While you could download and try importing into Excel, significant elements won't work, making it impractical.

If your concern is privacy, please see How do I know my Data is kept private?

A new version is released but I haven't received an invite email, what do I do?

Click here to request the latest invite.

Release emails can sometimes be marked as spam or placed in Gmail's Promotions tab. To prevent this, add the sender's email address (from your original invite) to your contacts.

If you still haven't received an invite, use the link above, post in the official Subreddit, or contact me via Reddit.

Note that only major releases are announced via email. Minor releases are published to the original link of the major release without announcements. To stay updated on minor releases, check the live changelog here.

I haven't received my Sheet invite, what do I do?

Please fill out the form here to request your invite.

How do I use the tool if I'm paid fortnightly?

First, in the SheetOptions tab, set your pay cycle to fortnightly and update your fortnightly pay amount. This helps the template understand your monthly income.

However, all calculations in the Sheet are performed on a monthly timescale to enable standardized date functions. Your tracking and statistics will be displayed in monthly intervals.

The dates in my Sheets keep ticking over and my history isn't being recorded, why is this?

To record your monthly progress, you must press the Red Update Button in the Net Worth Tab at least once a month:

This allows you to enter all your up-to-date values before recording the month. If you don't press this button, the Sheet will continue advancing to the next month until you update your Net Worth.

Note:

It's recommended to update your Net Worth on the 1st of every month

You must always record a month while in that month (e.g., November can only be recorded during November)

What are all the Sheet permissions for?

Full Version Permissions:

See, edit, create, and delete all your Google Sheets spreadsheets - To allow the Migration tool to automatically copy your data across from an older Sheet version when you upgrade to a newer version.

Connect to an external service - To allow the fetching of live Stock/Crypto/ETF prices from sources such as MorningStar, Yahoo, FT.com and CoinMarketCap where GoogleFinance does not provide a live price.

Send email as you - To send you a record of your end of month progress

Display and run third-party web content in prompts and sidebars inside Google applications - To display the end of month summary prompt in your Google Sheet (same content as the Email)

Slimmed Version Permissions:

View and manage spreadsheets that this application has been installed in - To allow the script to process your monthly numbers and then write them back to the Sheet as history in the History Tab

Connect to an external service - To allow the fetching of live Stock/Crypto/ETF prices from sources such as MorningStar, Yahoo, FT.com and CoinMarketCap where GoogleFinance does not provide a live price.

Display and run third-party web content in prompts and sidebars inside Google applications - To display the end of month summary prompt in your Google Sheet

Missing features - No migration tool (if the destination sheet), monthly email updates or calender invites/prompts.

I'm getting a popup saying 'Google hasn't verified this app'

This popup appears because the code running the sheet is bundled internally with the sheet. This approach ensures transparency and lets you review the code yourself.

You can audit the code via Tools -> Script Editor. Many community members have independently verified this code. See also the Data Privacy FAQ.

To proceed:

Click "Advanced" in the bottom left corner

Click "Go to CS Personal Savings Sheet v2"

Where can I see a changelog of the Sheet?

You can view the Sheet changelog here.

Can I make the Sheet into more of an app?

If you're using a Chromium browser (Google Chrome, Microsoft Edge, Brave, etc.), you can package your spreadsheet as a pseudo-app:

Open your Spreadsheet and select the tab you want to land on (e.g., Net Worth)

Click the browser menu button in the top right corner (3 dots/lines)

For Chrome: More Tools -> Create Shortcut; for Edge: Apps -> Install this site as an app

Name your shortcut

Pin it to your taskbar or desktop

Note that you'll need to set this up again if you upgrade to a new Sheet version, as each Sheet has a unique URL.

I've become a Patron, how do I get my Subreddit flair?

To get your unique r/CSPersonalFinance Patron Supporter flair, please click here. If your flair doesn't appear within 2 hours, contact me via Patreon for manual addition. Thank you for your support!

When I migrate the Sheet I get an "Exceeded maximum execution time" error

This can happen when there's a large or complex amount of data to migrate.

Try setting only half of the migration options to "Yes" at a time, and migrate each half separately. If that doesn't work, reduce the number of options set to "Yes" even further and migrate them separately.

You can run the migration as many times as needed—there's no harm, as the tool will just overwrite previously migrated data each time.

When I try and initialise I get a 'This app is blocked' error, what should I do?

Unfortunately this is a seemingly random error with extensive support threads across the internet for this issue. So far guidance has been this can often be when multiple Google accounts are signed in simultaneously. Other times it can be due to session scoring and whether or not Google deems a session to be high risk.

To resolve this:

Open an incognito window in Chrome. Often Firefox or Edge can sometimes fail browser checks.

Sign in with only one Google account

Initialize the sheet for the first time

If this fails to work, users have reported that using a second Google account often passes successfully. You can then share your sheet with full read/write permissions back to your master account for ongoing use.

Once the sheet has been successfully initialised at least once, you won't see this message again.

Where can I see the latest changes in the Sheet/Change log?

You can sign up for future Beta tests here to help improve the Sheet!

I'm moving country/region and need to change the currency or region of the sheet, how can I do that?

There are 2 ways to do this, with one being more complex than the other. Please note this is not an easy process to complete so keep a backup of your original sheet.

For example - if your sheet is region AUD, all your historical values, asset purchases and recorded values will be stored in AUD. Therefore you have 3 options to change to a different currency.

Option 1 - Easy Way

If you were to move to another country (take for example NZ) and kept the sheet in AUD then you would need to only make minimal changes. You'd just have to enter your new NZ Bank Accounts with the currency set to NZD so the sheet can convert this back to AUD. But for all intents all values across the sheet remain unchanged and displayed in AUD.

You would just change your input values in the sheet (ie. bank balances, salaries) to match your existing currency choice.

Option 2 - Advanced

But, if you wanted to change your entire sheet to NZD - this is where things get tricky. You could change the SheetOptions currency to NZD, but this does not go and convert all the historical values mentioned above to NZD. They are still locked in and recorded as AUD as they always were.

To truly cutover you would have to go through all your historical values in the History tab and asset purchase tables and convert them from AUD → NZD using the exchange rate at the time of the event. While this is doable, it does require getting very hands on with the sheet to do so.

Option 2 - Clean Slate

If neither of the above options are workable, you can always create a new copy of the sheet against your new region and start a blank slate. You can then keep your prior sheet for archival purposes, and maintain the new sheet against your new currency.

What does CompiledSanity stand for?

CompiledSanity is the Reddit username of the Sheet's creator and became the name by which the Sheet became known when first shared online. While the creator wishes they had chosen a more approachable name, by the time it gained popularity, the Sheet had become synonymous with "CompiledSanity." The name draws from programming workflows and some frustration with a particular task at the time.

The name may change in the future, but for now, it remains best known by this name.

Personal Circumstances

I'm paid irreguarly or with irregular amounts, how do I account for that?

You have two options:

Enter an average figure that you're comfortable with

Set your Salary to $0 and enter all your income into the Side Income tab, which is designed for irregular amounts and will automatically calculate an average for use throughout the template

How do I enter and account for my Mortgage Offset Account?

See the instructions to do this in the Property guide here.

How do I account for a Mortgage with both a fixed and variable component?

For mortgages with both fixed and variable components:

Create two separate mortgage entries in the Property tab

Set the monthly payment amount for each loan to 50% of your total contribution (or adjust according to your actual split)

How can I use my investments in my Retirement/Pension balance?

How does the Sheet account for multiple currencies?

The Sheet automatically handles multiple currencies on the fly. Assets can be priced in overseas currencies and converted to your base currency for comparison.

Setup steps:

Set the 'Base' currency (what everything will be converted to) in the SheetOptions Tab

In each tab, specify the currency for each item

Example: An Australian with Apple shares, a $20,000 US bank account, and a $200k USD house:

Download the AU Sheet version

Set Sheet Base Currency to AUD (SheetOptions Tab, cell L24)

In the Stocks Tab, enter 'NASDAQ:AAPL' as the ticker and 'USD' as the currency

In the Cash tab, enter the $20,000 USD balance and 'USD' as the currency

For the Property tab (which doesn't yet handle international currencies), pre-convert values to AUD before entry and update the Current Price as exchange rates change

Supported assets for international currencies:

Crypto (automatically converted)

Retirement Accounts (from Managed Funds tab)

How do I track with my partner/as a couple?

For couples, it's recommended to combine finances and incomes since expenses are typically incurred as a household. Net worth changes should be considered as a whole.

When setting the tax rate in the SheetOptions tab - use the CompiledSanity Partner Tax Calculator to work out an averaged tax rate. Your Salary will be the sum of your salaries.

Does the Sheet automatically sync with my Bank account?

Not currently, but this feature is planned for a future version.

How do I enter my Credit Card into the Sheet?

There are two ways to handle credit cards:

If you pay off your credit cards each month: Enter your credit card balance in the Cash tab as a negative number. This approach is appropriate for short-term debt that balances out monthly.

For long-term credit card debt you're working to pay down: Enter this into the Liabilities sheet.

How do I account for Salary Sacrificing?

Enter your income as the amount available to you after the salary sacrifice has been deducted. The Sheet focuses on usable money after tax/fees, ensuring savings rates are calculated correctly against post-sacrifice income.

How do I account for income from a rental Property?

Enter rental income in the Side Income tab. Rename one of the example columns and enter the after-tax rent received each month. You can also record rental income in the Property tab in the "Net Rent Profit To Date($)" row, which will contribute to your overall return calculations.

How do I account for a lease on my Car?

A novated lease (essentially a tax-incentivized rental before a potential balloon payment) should not be included in your net worth unless you decide to purchase the leased car.

The main place to record a lease is in the Budget tab, where you can enter your after-tax equivalent payment for the lease each month.

Investments

I have years of transactions for my investments, what should I do?

When setting up the Sheet, you have several options depending on how detailed you want your tracking to be:

Only enter transactions for holdings you currently own—previously sold assets don't need to be included

For the most accurate tracking (recommended): Enter all historical transactions for current holdings. While initial setup requires more time, this provides complete profit/loss breakdowns, accurate performance benchmarking, and proper Capital Gains calculations. After this initial work, monthly maintenance is minimal.

For a simplified approach: Combine all prior purchases for each holding into a single transaction. This ensures correct net worth inclusion but makes performance and CGT calculations less accurate.

Middle-ground option: If you enter an accurate average purchase price for your combined transaction, your Total Gain ($) figures will still be correct

Can I enter international assets into the Sheet and convert their currency automatically?

Yes! The v2 Sheet supports live currency conversion across various assets. This prices assets in their native currency and converts them to your local currency for performance metrics and net worth calculations.

Supported assets include:

Crypto (automatically converted)

Retirement Accounts from Managed Funds tab

How do I swap the ticker for an asset to update to a new pricing provider?

To change the pricing provider for an asset:

Find the NEW ID for your asset using these instructions

Open the investment tab containing the asset (ETF, Stock, Managed Fund)

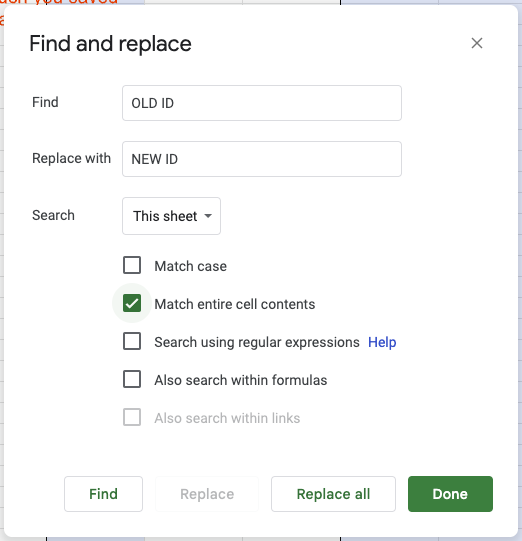

Click Edit → Find and Replace

Change the Search option from "All Sheets" to "This Sheet"

Check the "Match entire Cell contents" option

Enter the OLD ID in the Find box and the NEW ID in the Replace box

Click Replace All

Repeat Steps 3-7 in the Dividends Tab

This updates the old values in both your watch table and purchase history.

How do I enter my Spaceship/Raiz/Microinvestment Platform Investments?

For Spaceship Voyager: As of v2.10, Spaceship Voyager has live price support for all three fund types. In the Managed Funds tab, enter:

Fund ID: SPACEVOYUNIV

Fund Name: Spaceship Voyager Universe

Fund ID: SPACEVOYORIGIN

Fund Name: Spaceship Voyager Origin

Fund ID: SPACEVOYEARTH

Fund Name: Spaceship Voyager Earth

For Purchase History, enter your itemized purchases or a single purchase that you regularly update. Note that batching into a single purchase will make performance/gain figures less accurate.

Prices are updated every 24 hours.

For Raiz & Other Investment Platforms: You have two options:

Other Assets Tab (Easiest): Your investments will be recorded in your Net Worth; update the balance before recording each month

Managed Funds Tab: Enter your platform as a Managed Fund and manually update the Live Price as needed (ignore any warnings). Enter the Purchase History as provided by your platform.

How do I manage DRP or Dividend Reinvestment?

Enter reinvested distributions as new units in the ETF/Stocks tab—just like a normal purchase, but with $0 brokerage (overwrite the brokerage Column).

To determine the price and number of units purchased, check your Sharesight account or broker statement.

How do I return my investments to 3-4 decimal places?

Yahoo Finance, FT.com, and MorningStar tickers all return to 4 decimal places.

If you are using Google Finance tickers, please follow the instructions below.

By default, the Sheet displays live prices with 2 decimal places (the default from Google Finance).

To increase to 3-4 decimal places with Google Finance tickers:

In the watch table, go to the 'Live Price' column for the asset you want to change

Find the formula

GoogleFinance(A2,"price")Replace it with

GoogleFinance(A2,"marketcap")/GoogleFinance(A2,"shares")Update the cell reference A2 to match the row you're editing (keeping column A)

Note: This is not officially supported, as Market Cap and Share values from Google Finance may be delayed and might not reflect the live price. This only works for assets using the Google Finance API.

How do I account for Margin Loan Investments?

For margin loans, separate the investment and liability components:

Place all investments in the ETF/Stock tabs as appropriate

Add the loan component to the Liabilities tab

All proceeds such as dividends should be treated the same as normal holdings.

I've sold all my Shares of a particular holding, can I remove them from the Purchase History table?

It's recommended to keep sold holdings in the Purchase History table, as these figures still affect your cash flows for specific months. Removing past purchases will skew your Savings rate calculations and potentially make other Sheet statistics incorrect.

Furthermore, removing sold holdings will also effect your CGT estimate (if applicable to you).

I keep running out of Crypto API calls, why is that?

If you're using a Sheet before v2.10.8, upgrade to the latest version—the new Crypto price fetching has been completely rewritten and reduces CoinMarketCap API calls by up to 95%.

Additionally, old archived Sheets may still be checking Crypto prices. After updating to a new Sheet, remove the Crypto API key in the SheetOptions Tab from your old sheets. As of v2.11, this process is automated.

I received some Crypto for free, how do I enter that?

Free Crypto should be entered as Crypto Staking Income, not as a $0 purchase. Entering it as a purchase at $0 will result in incorrect CGT and performance values, as well as incorrect gain calculations for tax purposes (free Crypto is usually treated as income, not a capital gain, depending on your region).

Follow these instructions on entering free Crypto correctly.

How do I manage private equity stocks?

Enter private equity as you would a normal stock purchase, but manually enter and update the 'Live Price' (ignore any warnings).

Note that when upgrading Sheet versions, you'll need to manually enter the Live Price in your new Sheet.

How do I account for a lease such as a Car?

A lease (tax-incentivized rental with optional final balloon payment) doesn't factor into your net worth until you purchase the vehicle. During the lease period, the asset is owned by the leasing company.

The main place to track the lease is in the Budget tab, where you can enter your after-tax lease payment each month.

How do I manage selling a property or home?

While this process is being improved, current steps are:

Set the original property's current value and mortgage value to $0

If purchasing a new home, add it as a new column in the Property Tab

Make sure any residual cash balance is reflected in the Cash tab

A simpler approach for rental properties:

Remove the property from the Property tab

Add the proceeds to a cash account

Future features may include property CGT estimations and improved performance forecasting. Leaving sold properties in the tab preserves history for future Sheet versions.

My Crypto live price says 'Old Sheet', why is that?

If you see 'Old Sheet' instead of a live price, you're using the sheet you migrated from (your 'old' sheet). The migration tool deactivates Crypto price fetching in old sheets to prevent them from exhausting your API allowance.

You have three options:

Use the new sheet you previously migrated to

Set up a brand new sheet and migrate to this sheet

Clear cell SheetOptions!B50 which flags that the sheet is 'older'

Errors

Permission Based errors

When using certain functions of the sheet, you may see these errors:

You do not have permission to call MailApp.sendEmail

You do not have permission to call Ui.showModalDialog

Error with Previous Sheet URL or Error accessing previous Sheet

This is usually caused when granting permissions when first setting up the sheet. During this setup process you are shown the following screen:

Please make sure to select all to avoid any sheet messages. If you unselect any of the above, the sheet will still support core functions but certain features may be disabled. Errors may safely be ignored.

To see a list of what these permissions do and what features will be impacted, please see here.

Last updated